Cryptocurrency Posts

Crypto Briefing

Coinbase's expansion into nano futures could enhance market liquidity and accessibility, potentially attracting more US traders to crypto derivatives.

The post Coinbase to launch nano XRP and SOL perpetual futures for US traders on August 18 appeared first on Crypto Briefing.

Marti's crypto investment strategy may influence other tech firms to explore digital assets as a hedge against market volatility.

The post Turkey’s mobility super app Marti allocating 20% of cash reserves to crypto, starting with Bitcoin appeared first on Crypto Briefing.

Kraken's valuation pursuit and potential IPO could significantly impact the crypto market's dynamics and investor confidence.

The post Kraken targets $15 billion valuation with new funding round before IPO appeared first on Crypto Briefing.

The SEC has approved in-kind creation and redemption for Bitcoin and Ethereum ETFs, aligning them with traditional commodity ETPs.

The post SEC greenlights in-kind redemptions for Bitcoin and Ethereum ETFs appeared first on Crypto Briefing.

Strategy buys 21K BTC using proceeds from its $2.5B STRC stock IPO, bringing total holdings to 628,791 BTC.

The post Strategy acquires 21K BTC after $2.5B STRC stock sale appeared first on Crypto Briefing.

Bitcoin Magazine

Bitcoin Magazine

Strategy Purchases 21,021 Bitcoin After $2.52 Billion IPO

Strategy, the leading bitcoin corporate treasury company, announced it has purchased 21,021 BTC at an average price of $117,256, using proceeds from its $2.52 billion IPO of Series A Perpetual Stretch Preferred Stock (STRC). The acquisition brings Strategy’s total holdings to 628,791 BTC, valued at roughly $80 billion.

The offering, priced at $90 per share for 28,011,111 shares, is the largest US IPO of 2025 and one of the biggest bitcoin-related equity raises in recent history. Strategy netted $2.474 billion after expenses and used nearly all of it to buy more bitcoin, continuing its aggressive accumulation strategy without diluting common shareholders.

The stock is set to begin trading on the Nasdaq Global Select Market around July 30 under the ticker STRC. The stock features a variable 9% annual dividend, paid monthly, and is designed to trade near its $100 par value. It’s the first U.S. exchange-listed perpetual preferred security from a bitcoin treasury firm with a monthly dividend rate.

It is the largest exchange-listed preferred stock issuance since 2009 and introduces a short-duration, income-generating security designed to appeal to yield-focused investors. Strategy also retains redemption and repurchase rights, along with investor protections such as dividend accrual and tax-related redemption options.

“Morgan Stanley, Barclays, Moelis & Company, and TD Securities acted as joint book-running managers,” stated the press release. “The Benchmark Company, Clear Street, AmeriVet Securities, Bancroft Capital, Keefe, Bruyette & Woods, and Maxim Group LLC served as co-managers.”

Just a week earlier, Strategy disclosed a $740 million bitcoin purchase of 6,220 BTC, pushing its total holdings well above 600,000 BTC. Analysts from TD Cowen project the company could acquire another 17,000 BTC over the next decade under its 42/42 program, which aims to raise $84 billion for bitcoin purchases by 2027.

This post Strategy Purchases 21,021 Bitcoin After $2.52 Billion IPO first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

Bitcoin Magazine

Bitcoin Holds Firm at $118,000 as Trump’s Crypto Report Nears Release

Bitcoin remains steady at $118,000 as markets await the Trump administration’s highly anticipated digital assets report, expected to be released tomorrow. The report is the first major crypto policy report under President Trump and could mark a historic shift in US support for Bitcoin and related technologies.

The White House report is the result of months of work from the President’s Working Group on Digital Assets, led by David Sacks and Bo Hines. Crypto In America’s Eleanor Terrett, formerly of Fox Business, says it may include proposals for funding the strategic Bitcoin reserve, include further information on the national digital asset stockpile, regulatory clarity, and national security measures to counter illicit finance and sanctions evasion.

Bitcoin has already climbed 26 percent in 2025, driven by increasing institutional interest and a wave of supportive legislation. One of the most impactful developments was the signing of the GENIUS Act, which established a comprehensive framework for regulating stablecoins. This was followed by the House passing the CLARITY Act and the Anti-CBDC Surveillance State Act, signaling clear resistance to government controlled digital currencies and a shift in favor of decentralized digital assets such as Bitcoin.

On the legislative front, the Senate Banking Committee is expected to release a draft of its market structure reforms this week. Additionally, the Senate Agriculture Committee is holding a vote today on Brian Quintenz’s nomination to lead the CFTC, a regulator in the Bitcoin market, the CFTC could see a shift toward more bitcoin friendly leadership if Brian Quintenz’s nomination is confirmed, potentially shaping future oversight in favor of digital assets.

Meanwhile, institutional players continue to validate Bitcoin’s role in global finance. A recent report from the BlackRock Investment Institute called 2025 a banner year for Bitcoin, noting that the US is becoming the bitcoin and crypto capital of the world. BlackRock also highlighted the rapid rise of stablecoins, which now have a combined market cap of $250 billion. This growth reflects the mainstreaming of blockchain-based assets and increasing investor confidence in digital finance.

With policy momentum accelerating and federal attention focused on digital assets, Bitcoin’s current stability may be the beginning of a much larger move as the US positions itself at the forefront of the crypto economy.

This post Bitcoin Holds Firm at $118,000 as Trump’s Crypto Report Nears Release first appeared on Bitcoin Magazine and is written by Oscar Zarraga Perez.

Bitcoin Magazine

Twenty One Capital CEO Jack Mallers Says Bitcoin Price Will Continue to Rise Above $150,000

In a bold and high-energy appearance on Bloomberg Crypto, Jack Mallers, CEO of Twenty One Capital, made clear his company’s ambition: to be the most dominant Bitcoin treasury in the world—and to ride Bitcoin’s value far past the six-figure mark.

Following the firm’s announcement that it expects to receive an additional 5,800 BTC from Tether ahead of its public listing, Mallers laid out the case for Bitcoin’s continued price surge, asserting that $150,000 per BTC is just the beginning.

“Is there enough Bitcoin for me at $120k? No. $130k, $140k, $150k? There’s always Bitcoin available—it just depends on what you’re willing to pay for it,” Mallers said. “Bitcoin is the scarcest thing. It is inelastic to the amount of demand that searches for it.”

With the upcoming capital infusion, Twenty One’s total bitcoin holdings will exceed 43,500 BTC, acquired at an average price of $87,280.37—already generating $1.3 billion in unrealized gains. This will make the company the third-largest corporate holder of bitcoin, behind only Strategy and Marathon Digital (MARA).

Mallers was unapologetically aggressive when asked about his intentions to move further up the leaderboard.

“I’m never gonna sit up here and say I want to be second,” he told Bloomberg. “The board consists of myself, Tether, and SoftBank. That’s a lot of access to capital, a lot of tech experience, and a lot of Bitcoin expertise. We think we can do pretty much anything.”

More than just stacking sats, Mallers emphasized that Twenty One is building for the long term. Alongside its treasury accumulation, the company plans to develop a suite of Bitcoin-native financial products, leveraging the experience of Mallers’ own firm Strike and the engineering pedigree of partners like Tether.

Twenty One’s structure is designed to offer Bitcoin-denominated shareholder value, with each share expected to represent approximately 12,559 sats. A new metric, Bitcoin Per Share (BPS), will offer real-time transparency on asset exposure. All BTC will be on-chain and auditable via xxi.mempool.space.

“Bitcoin is a foundational protocol for freedom,” said Paolo Ardoino, CEO of Tether. “Twenty One captures that ethos in corporate form.”

As Mallers put it: “We’re not here to beat the existing system—we’re here to build a new one.”

The firm is set to trade under ticker XXI following the closing of its business combination with Cantor Equity Partners (CEP), pending shareholder approval.

With Bitcoin’s fixed supply and rising institutional demand, Mallers believes price discovery will only accelerate from here. “The more people and capital that enter this market, the higher the price must go,” he said. “And we’re just getting started.”

This post Twenty One Capital CEO Jack Mallers Says Bitcoin Price Will Continue to Rise Above $150,000 first appeared on Bitcoin Magazine and is written by Nik.

Bitcoin Magazine

Tornado Cash, the Only Useful Ethereum Product, Is About To Be Made Illegal

Many projects have been created on top of Ethereum. Fans of the project will talk up the fruits of that blockchain if you let them, but having seen the project’s growth firsthand since its inception in Toronto in 2014, I can’t see anything that’s aged well or had a more profound impact on the world than Tornado Cash.

While stablecoins and decentralized exchanges have passed through Ethereum and migrated to chains like Solana and Tron, and the store of value use case has been firmly cornered by bitcoin. Tornado Cash remains a stand-alone wonder of the (otherwise arguably overhyped) smart contracting platform.

Unlike many of the projects imagined in the early days of Ethereum — smart home lock systems, self-driving cars that pay their own bills via ETH and governed via a smart contract — Tornado Cash has actually been implemented and found product-market fit. It serves as a practically immutable monetary VPN, a tool that still functions today even after its developers were arrested: Roman Storm stands trial in the U.S. right now.

In fact, of all the applications that have been launched on Ethereum, Tornado Cash is the one that’s drawn the most hostility from governments throughout the world, while also gathering significant support from its users, fans and even Ethereum critics like myself. Proving not only that Ethereum may indeed be decentralized enough to merit the title, but can actually create disruptive and anti-establishment tools that can defend the fundamental rights of individuals regardless of who or where they are.

You will, no doubt, hear condemnation of the project from establishment mouthpieces; they will say that Tornado Cash is a tool for laundering criminal proceeds and that scammers use it to protect their ill-gotten gains. What you won’t hear from the people taking the stand in the Roman Storm trial is that Tornado Cash is a rare defense of the universal right to privacy for people throughout the world. An ‘institution’ by merit of its immutability, Tornado Cash has the power to safeguard the financial privacy of innocent and law-abiding users who face active harassment by organized cyber crime, rogue authoritarian governments and a rising surveillance-state hydra that ignores constitutional protections to civilian privacy, without punishment.

While Roman Storm might not have an easy future ahead of him as he fends off prosecutors who represent the waning U.S. empire’s overused tariff regime and obsolete financial regulation, the most ironic justice that might be available in the meantime is for the world to learn how to use the Tornado Cash contract.

If you are curious about the Roman Storm case and want to support his defense, follow Frank Corva, who is attending the trial this week and reporting on it live.

This post Tornado Cash, the Only Useful Ethereum Product, Is About To Be Made Illegal first appeared on Bitcoin Magazine and is written by Juan Galt.

Bitcoin Magazine

Wall Street Veteran Reconfirmed Bitcoin Price To Hit $444,000

Josh Mandell, the former Salomon Brothers and Caxton Associates trader who accurately predicted Bitcoin’s March 14 surge to $84,000, has reaffirmed his forecast that the Bitcoin price will reach $444,000 amid unprecedented institutional buying. “$444K IS THE DESTINATION,” Mandell wrote previously.

In a recent post on X, Mandell, whose trading portfolio grew from $2 million to over $23 million in the past year, reconfirmed his conviction in Bitcoin’s trajectory to $444,000. His latest statement comes as corporate treasuries continue to accumulate Bitcoin aggressively. He also predicts Bitcoin to hit $84,000 before it marches towards $444K.

Mandell’s prediction is gaining credibility amid a wave of institutional Bitcoin purchases. Over the past week, Strategy (MSTR) raised $2.5 billion through its STRC preferred stock IPO to acquire more Bitcoin, while MARA Holdings completed a $950 million convertible note offering primarily for Bitcoin purchases. Meanwhile, Japanese tech firm Metaplanet added 780 BTC worth $92.5 million to its treasury.

Corporate treasuries are no longer testing the waters – they’re diving in headfirst. From Strategy’s 607,770 BTC holding to MARA’s planned purchases, we’re seeing unprecedented institutional demand.

TD Cowen analysts note that Strategy alone could add another 17,000 BTC without diluting shareholders, while other companies are rapidly following suit. The combined corporate Bitcoin holdings now exceed $100 billion, with new entrants emerging weekly.

The path to $444,400 appears increasingly plausible given the convergence of institutional forces. BlackRock’s pioneering Bitcoin ETF has already accumulated over 390,000 BTC since its January launch last year, with recent SEC filings showing accelerating inflows across all spot ETF providers. Combined with Michael Saylor’s aggressive accumulation strategy at Strategy, institutional demand is creating unprecedented pressure on Bitcoin’s limited supply.

The combination of ETF adoption, corporate treasury buying, and improved custody infrastructure from firms like Coinbase has removed traditional barriers to institutional participation. When you factor in the Federal Reserve’s likely pivot to looser monetary policy by year-end, the macro backdrop strongly supports Mandell’s thesis.

Mandell’s track record lends weight to his predictions. His expertise stems from decades of institutional trading experience, including stints at Wall Street giants during the high-octane 1990s. Rather than relying on technical analysis, Mandell attributes his accuracy to deep market intuition and macro understanding.

Bitcoin currently trades near $119,000, up from its recent dip to $115,000 last week. The total cryptocurrency market capitalization has rebounded above $4 trillion, supported by growing institutional involvement.

At press time, Bitcoin is trading at $118,930 as markets digest the latest wave of corporate adoption news. Whether Mandell’s bold prediction proves as accurate as his last one remains to be seen, but one thing is certain – institutional appetite for Bitcoin shows no signs of slowing.

This post Wall Street Veteran Reconfirmed Bitcoin Price To Hit $444,000 first appeared on Bitcoin Magazine and is written by Vivek Sen.

CryptoSlate

Ethereum ETFs experienced a record inflow streak last week, adding a net $2.31 billion ovst seven trading sessions between July 18 and July 28. Five of those days saw net inflows exceed $230 million, with the largest single-day inflow of $533.8 million recorded on July 22.

This surge in inflows has dwarfed previous weeks and increased the post-launch average, which had been suppressed for months due to persistent outflows from Grayscale’s converted ETHE fund.

For context, average daily net inflows across all issuers during this seven-day window reached $331 million, nearly nine times higher than the ETF market’s lifetime daily average of approximately $37 million. In absolute terms, this past week accounted for almost 25% of all net flows since Ethereum ETFs launched in July 2024.

The most active day was Tuesday, July 22, when $533.8 million was added amid a brief dip in Ethereum’s spot price to $3,748. This indicates that flows weren’t reacting just to price. Instead, the consistency of creations across both up and down days in ETH shows that these flows are structurally motivated.

ETH closed at $3,800 on July 28, up 7.0% from its $3,550 close on July 18. Much of this upside occurred in the early part of the weekly streak. On July 21, ETH climbed nearly 6% while ETFs added $296.5 million in net flows. After that, ETH mostly consolidated in the $3,600-$3,750 range, even as inflows remained steady.

This divergence between flow strength and price direction shows us that the demand for ETH exposure is most likely driven by long-term positioning. The 30-day rolling correlation between ETF flows and ETH’s daily returns rose to 0.60 last week, the highest since February.

BlackRock’s ETHA ETF remains the dominant driver of net inflows, contributing $1.82 billion during the seven-day period, roughly 79% of total creations. However, other issuers also began showing signs of life. Fidelity’s FETH saw a $210 million single-day creation on July 24, matching its total for the entire month of May. However, this was followed by a $49.2 million outflow on July 28, suggesting the inflow may have been linked to tactical or arbitrage strategies rather than discretionary positioning.

Bitwise’s ETHW added $48 million over the week, while combined flows from 21Shares, VanEck, Franklin, and Invesco added another $60 million. Grayscale’s ETHE, while still bleeding capital, showed signs of stabilization. Outflows slowed to an average of $18 million per day during this period, down from $94 million in March. The two-day total outflow on July 24 and 25 was just $42 million, marking the smallest two-day window since February.

This fading drag from ETHE is likely improving sentiment for the broader ETF suite, reducing the negative pull on net creation metrics and improving aggregate AUM momentum.

While the $65 million net inflow on July 28 was materially lower than the preceding days, it’s premature to interpret it as a reversal. Most major funds still recorded inflows, and the negative print came entirely from Fidelity. As discretionary managers assess whether to rebalance further into Ethereum ETFs, July’s closing stretch may offer a first glimpse into a stable post-repricing baseline.

The ETF flow-to-price feedback loop is clearly strengthening. If spot ETH maintains a foothold above $3,800 while flows hold north of $150 million per day, the next leg higher could be built on something far more durable than retail speculation or protocol narrative cycles: it may be rooted in ongoing portfolio allocation.

The post Ethereum ETF inflows cross $2.3B in a week as demand intensifies appeared first on CryptoSlate.

Teucrium 2x Long Daily XRP ETF (XXRP) reached $323.6 million in net flows this week, being the first XRP exchange-traded fund (ETF) traded in the US to surpass the $300 million threshold.

According to VettaFi’s data, XXRP now represents 52.5% of the total $616 million in net flows registered by US-traded XRP ETFs.

Notably, all exchange-traded products (ETPs) tied to XRP in the US are pegged to derivatives, with the SEC yet to greenlight spot products as of July 29.

Two-digit growth

According to CoinShares, XRP ETPs captured $189 million in inflows last week. XXRP’s $73.4 million in net flows then represented 39% of the global flows, and a 22.7% weekly growth in inflows.

On July 21, XXRP saw the most significant daily volume of any XRP ETF in the US to date, capturing $50.4 million.

The Teucrium ETF is the oldest of the four XRP ETFs traded in the US, launched on April 8. On May 22, Volatility Shares launched its XRP products, the funds XRPI and XRPT. While XRPI offers no leverage, XRPT offers exposure to 2x leverage.

XRPI registered $124.6 million in inflows as of July 28, according to data from ETF.com. XRPT posted nearly $168 million in net flows in the same period.

Regarding last week’s performance, Volatility Shares’ funds registered similar growth. XRPI total inflows increased by 27% by $33.6 million. At the same time, XRPT added $43.6 million in inflows, growing 26%.

The youngest of the bunch is ProShares Ultra XRP ETF (UXRP), which became live on July 16. Since then, the 2x leverage ETF captured roughly $101,000 in inflows.

Outpaced by Solana products

Despite surpassing Solana (SOL) in total market cap to become the third-largest crypto, XRP ETPs still register a smaller inflow count than SOL-related products this year.

XRP-based products closed June with nearly $410 million in year-to-date flows, against SOL’s $292.5 million.

However, XRP products now amount to $721 million in the global total net flows, losing ground to Solana-tied ETPs and their $844 million in inflows.

The post Teucrium’s 2x XRP ETF tops $300M in flows, dominates 52% of the market appeared first on CryptoSlate.

Strategy closed a $2.521 billion initial public offering of its Variable Rate Series A Perpetual Stretch Preferred Stock (STRC) and immediately used the proceeds to expand its Bitcoin (BTC) reserve.

The company said it purchased 21,021 BTC at an average $117,256 apiece, lifting holdings to about 628,791 BTC as of July 29. The aggregate cost basis now stands near $46.8 billion, about $73,227 per BTC.

According to Bitcoin Treasuries data, Strategy now accounts for 62.3% of the total Bitcoin held by publicly listed companies.

STRC is priced at $90 per share for 28,011,111 shares and is expected to begin trading on the Nasdaq Global Select Market around July 30.

Strategy’s net proceeds from the offering amounted to roughly $2.474 billion after underwriting and expenses and helped fund the firm’s latest Bitcoin acquisition.

STRC launches tomorrow

Strategy framed the STRC deal as a financing milestone, being the largest US initial public offering (IPO) of 2025 to date by gross proceeds and the most extensive exchange‑listed perpetual preferred offering since 2009.

Once listed, STRC will be the first US exchange-listed perpetual preferred security issued by a Bitcoin Treasury Company to pay monthly dividends and the first to adopt a board-determined monthly dividend-rate policy, the company believes.

The security also introduces a short‑duration, income‑oriented instrument to Strategy’s preferred‑stock lineup, aimed at attracting income‑focused investors.

Underwriters included Morgan Stanley, Barclays, Moelis & Company, and TD Securities as joint bookrunners, with The Benchmark Company, Clear Street, AmeriVet Securities, Bancroft Capital, Keefe, Bruyette & Woods, and Maxim Group as co‑managers.

The offering was sold via an effective shelf registration with a final prospectus supplement available via the SEC. The transaction advances Strategy’s balance‑sheet model of raising capital in public markets and converting it into additional Bitcoin reserves.

A new offering

Stretch is the fourth offering from Strategy this year. The firm announced Strike (STRK) on March 9, offering a fixed 8% dividend, with the company setting up a $21 billion at-the-market (ATM) program.

On March 17, Strategy announced a second offering with a fixed 10% dividend, called Strife (STRF). The company established a $2.1 billion ATM program for ongoing issuance.

The last one before the STRC offering is Stride (STRD), an IPO priced at $85 for 11,764,700 shares. A $4.2 billion ATM program later supplemented the offering and fixed a 10% coupon.

The post Strategy buys nearly $2.5B worth of Bitcoin to make up 62% of total BTC in treasuries appeared first on CryptoSlate.

Senator Cynthia Lummis (R‑Wyo.) introduced the 21st Century Mortgage Act on July 29, legislation that aims to bring US underwriting into the digital era by requiring Fannie Mae and Freddie Mac to consider digital assets when assessing single‑family mortgage eligibility.

The bill directs the government‑sponsored enterprises to recognize assets recorded on cryptographically secured ledgers and bars lenders from forcing borrowers to convert those holdings to dollars simply to be counted in risk models.

Lummis framed the measure as a response to a homeownership slump among younger Americans and the reality that many now build savings in crypto.

She stated:

“Rather than punishing innovation, government agencies must evolve to meet the needs of a modern, forward‑thinking generation.”

Furthermore, the Senator noted Census data showing homeownership under age 35 at 36.6% in the first quarter and survey estimates that 21% of US adults hold cryptocurrency, with two‑thirds of owners under 45.

Crypto gaining momentum

The legislation would codify a policy shift already underway at the Federal Housing Finance Agency (FHFA).

Director Bill Pulte has ordered Fannie and Freddie to treat cryptocurrency reserves as eligible assets in single‑family loan risk measurements and to draft plans for recognizing those balances without first liquidating them.

He also announced a broader review of how digital asset holdings, including Bitcoin, should factor into mortgage evaluations.

The FHFA oversees the housing finance system, including Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, and its moves mark a break from past practice in which underwriters typically accepted cash, securities, and retirement accounts but excluded crypto because of volatility and unclear rules.

Recognition would not permit borrowers to repay mortgages in crypto, although it would allow verified digital asset balances to be counted alongside traditional assets in capacity and risk tests.

The bill comes amid a wider shift among regulators toward crypto policy under the current US administration.

The post Senator Lummis introduces legislation to make Fannie and Freddie count crypto in mortgage risk checks appeared first on CryptoSlate.

BlackRock stated that stablecoins now sit at the heart of the “future of finance,” and the recently approved GENIUS Act gives them a clear lane as everyday payment instruments.

In a July 28 report, the BlackRock Investment Institute wrote that stablecoins “look here to stay” and that recent legislation cements their use in payments rather than as investment products.

The firm tied that view to the GENIUS Act, which creates a federal framework for payment stablecoins. The paper defines stablecoins as digital tokens that are pegged to fiat and hold reserves.

Furthermore, it tracks rapid adoption since 2020 to roughly $250 billion, or about 7% of the crypto market by value.

Officially a payment method

BlackRock detailed how the law rewrites the rulebook. Legislation now classifies stablecoins as a payment method, bans interest on balances, and confines issuance to federally regulated banks, some registered nonbanks, and state-chartered firms.

The report assessed that this structure can strengthen the dollar’s role by enabling a tokenized dollar payment network for cross-border use. At the same time, the interest ban may curb take-up in major economies that already offer attractive bank deposits.

The note also drills into reserves. Issuers would hold mostly repos, money market funds, and US Treasury bills with 93 days or less to maturity. BlackRock pointed to Tether and Circle as the largest buyers, with at least $120 billion in T-bills, about 2% of the roughly $6 trillion in bills outstanding.

Even if demand grows, the institute expects only a small effect on bill yields because money would largely rotate from similar assets, and the Treasury plans to keep expanding bill supply.

Fight for dominance

The institute places the US shift within a global contest. Hong Kong is moving to attract stablecoin activity, while Europe is studying a digital euro with guardrails to prevent harm to banks.

If other jurisdictions allow interest-bearing stablecoins or push central bank alternatives, the dollar’s role in trade finance could face new competition. However, US officials could address this by allowing interest in the future.

On market plumbing, BlackRock expects limited effects on short-term Treasury yields from stablecoin growth, while it keeps bitcoin separate as a distinct return driver.

The post BlackRock says clear US rulebook turns stablecoins into payment method of the ‘future of finance’ appeared first on CryptoSlate.

Cryptoticker

Linea Launches the Most Ethereum-Centric Layer 2 Yet

Linea is rewriting the rules of Layer 2 design — not by mimicking Ethereum, but by becoming its most natural extension. In its latest announcements, Linea introduced a bold framework featuring native ETH yield, protocol-level ETH burn, and an Ethereum-native Consortium to manage the largest ecosystem fund in L2 history.

With more than $100B in $ETH staked and over $25T in transaction volume, Ethereum is already the world’s dominant settlement layer. Now, Linea aims to accelerate Ethereum's dominance by offering aligned economics, capital efficiency, and unparalleled developer incentives.

First-Ever ETH Burn on a Layer 2

In a move that directly benefits the Ethereum mainnet, Linea becomes the first L2 to burn ETH at the protocol level. Specifically, 20% of all net transaction fees (paid in ETH) will be burned — permanently reducing ETH supply, supporting Layer 1 value accrual, and driving long-term ETH value.

This mechanism is a first among rollups and highlights Linea’s commitment to reinforcing Ethereum’s economic model, not extracting from it.

Bridged ETH Will Earn DeFi Rewards

Unlike most L2s that idle bridged ETH, Linea introduces native ETH yield. ETH deposits on Linea will earn staking rewards, which are distributed to liquidity providers (LPs). LPs also benefit from returns across DeFi activity on the network, creating some of the best risk-adjusted returns in crypto.

This means users no longer have to choose between capital efficiency and yield — Linea delivers both.

A $100B Ecosystem Fund with Ethereum-Aligned Distribution

Linea is also launching the largest L2 ecosystem fund to date — with 85% of tokens going to the community:

- 75% toward builders and ecosystem development

- 10% for early users

- 15% to the ConsenSys treasury, with a 5-year lockup

There are no insider allocations. No private rounds. No value extraction. Just Ethereum-aligned incentives, echoing the Genesis spirit of ETH’s original launch.

Managed by the Ethereum-Native Consortium

The newly formed Linea Consortium will oversee fund allocation and governance. Founding members include:

- EigenLayer

- ENS Domains

- SharpLink

- Status

- ConsenSys

This group consists of projects that already strengthen Ethereum’s infrastructure — and more members are expected to join soon.

Linea’s Vision: Where Ethereum Wins

Linea combines full Ethereum equivalence (same dev tooling, same opcodes) with ETH as the native gas token, ETH burns, capital-efficient mechanics, and ecosystem-first tokenomics. This makes it the most Ethereum-aligned L2 in existence — one where both technology and economics serve Ethereum first.

Dogecoin Recent Price Action: Why did Dogecoin Crash?

$DOGE began the session at $0.240, rallied to $0.248, then plunged during heavy U.S. trading hours, hitting a low of $0.223. A late rebound lifted the price back to $0.226, indicating that buyers were accumulating near the support zone. Notably, volume during the sell‑off spiked to 918 million, more than 2× the 24‑hour average. This indicates that large players may have triggered stop‑loss orders, which could create a base for recovery if demand returns.

Looking at the past 7-days, the chart looks even grimmer, with more than -18% losses.

DOGE/USD price chart in the past week - TradingView

Technical Outlook for Dogecoin Price

| Level | Significance |

|---|---|

| $0.248 (recent high) | Short‑term resistance; failure to sustain rally triggered the sell‑off. |

| $0.240–$0.241 | Key resistance zone—needs to break for bullish reversal. |

| $0.223–$0.225 | Strong support tested twice; heavy volume suggests accumulation. |

| $0.215–$0.218 | Next support if $0.223 fails. |

Dogecoin Price Prediction: Important Levels to Watch

Given the heavy sell‑off and subsequent bounce from the $0.223 area, the near‑term outlook is cautiously optimistic. If DOGE holds above $0.223 and can reclaim $0.241, the price could retest $0.260 within days. However, failure to maintain support may send it toward the $0.215–$0.218 range. Investors should monitor U.S. inflation data and Federal Reserve commentary, as macro headwinds may prolong volatility.

How to Trade Dogecoin?

- Identify your exchange – Compare fee structures and liquidity using our exchange comparison guide.

- Monitor price levels – Watch the $0.223 support and $0.241 resistance zones closely.

- Understand the asset – For new traders, read up on blockchain basics to appreciate the technology behind DOGE.

For live pricing and charts, visit the DOGE price page.

Ethereum is no longer just a tech play or a speculative asset. It is becoming a strategic reserve for public companies. In just two months, corporate treasuries have acquired over 1.26 million ETH, and analysts at Standard Chartered say that is just the beginning. With projections suggesting these firms could eventually control ten percent of all Ethereum in circulation, this new wave of accumulation is not just a bullish signal — it may permanently shift the supply dynamics. What happens to price when major firms start treating ETH price like digital oil? Let’s take a closer look.

Ethereum Price Prediction:Treasury Firms Quietly Accumulating ETH

Ethereum price is not just riding another market cycle. Something deeper is unfolding. Corporate treasury firms have quietly picked up over 1.26 million ETH since June. That is already one percent of the total ETH supply. According to Standard Chartered, this is only the beginning. The bank’s head of digital assets research, Geoffrey Kendrick, believes this number could increase tenfold. That would mean treasury firms holding ten percent of all Ethereum in circulation.

This shift is not just about stacking coins. These companies are leveraging ETH for staking rewards and tapping into decentralized finance strategies that ETFs still cannot access. They are treating Ethereum as both a store of value and a productive asset. That changes the long-term demand equation in a big way.

How This Compares to Bitcoin?

For context, Bitcoin treasury firms currently hold around 4.4 percent of the BTC supply. MicroStrategy alone holds nearly 3 percent. Ethereum is already seeing faster adoption in this area. SharpLink Gaming now holds over 438,000 ETH after its latest acquisition. BitMine is aiming for five percent ownership, which translates to around 6 million ETH. These are massive numbers for a network where staking yields and DeFi integration offer built-in value capture.

Ethereum Price Prediction: What the Chart Is Telling Us Right Now?

On the technical side, Ethereum price is consolidating just under the 3900 mark. It hit a recent high near 3886 and has held steady near the upper Bollinger Band. The uptrend that began in early July remains intact. The price is comfortably above the 20-day moving average, signaling continued momentum.

Fibonacci pivot levels suggest 3800 is a key zone. Holding this level opens the door for another push toward 4000. If that level is breached with strong volume, the next major zone lies between 4500 and 4700. A failure to hold above 3750 could trigger a short-term correction, but there is strong support between 3500 and 3200.

The Supply and Demand Imbalance Ahead

Here is where it gets interesting. If corporate treasuries do scale up to ten percent of all ETH, that would mean another 8.7 million ETH being pulled from circulation. At current prices, that is more than 33 billion dollars in potential demand. And that does not even factor in ETH ETFs, which have already added 2 million ETH in the same two-month period.

This creates a long-term supply shock that is hard to ignore. Unlike traders or retail buyers, these treasury firms are not looking for quick exits. Their goals are long duration, low liquidity movement, and strategic exposure. That translates into fewer coins available on the open market.

What Comes Next for Ethereum Price?

If Ethereum price manages to flip 4000 into support, the technical setup aligns with the narrative of long-term demand from institutional buyers. The structure on the daily chart suggests a bullish continuation is still the path of least resistance.

But the real story is less about chart patterns and more about ownership patterns. As more companies follow BitMine and SharpLink into ETH accumulation, the market will start to reflect that in price action. ETH price is not just reacting to the market anymore. It is starting to reshape it.

Trade ETH with OKX & Win Big

Join the OKX McLaren Giveaway Campaign by trading ETH for a chance to win:

- A real McLaren experience

- Special ETH trading rewards

- Hassle-free onboarding for new users

Trade ETH on OKX today and be part of what’s next in crypto.

$ETH, $Ethereum, $ETHPrice, $EthereumPrice, $ETHETF, $StandardChartered

Mill City Ventures just threw down $450 million to make SUI its primary treasury asset. That kind of capital injection is rare in the crypto world, especially from a Nasdaq-listed firm shifting from traditional finance into digital assets. What makes it more interesting is their near-total bet on SUI, with 98 percent of funds allocated to the token.

SUI Price Prediction: What Does the Chart Say?

SUI price recently pushed above key resistance near $3.85 and tagged the upper Bollinger Band around $4.35. That move was followed by a brief pullback, but the price is now sitting right on top of the 20-day moving average. This kind of structure—tight range, expanding Bollinger Bands, pullback on low volume—often leads to continuation moves.

Pivot point clusters between $3.80 and $4.10 are acting as the new battle zone. If bulls hold this line, a break above $4.35 would open up space toward $5.18, which coincides with the R1.618 Fibonacci extension from the recent impulse.

Is the Treasury Buy-In Already Priced In?

Not quite. This isn’t just a VC raise. This is a full-scale institutional conversion of corporate reserves into SUI tokens, backed by names like Pantera, Galaxy, and Electric Capital. The actual token acquisition will likely be spread out, and with Galaxy managing the treasury, accumulation is expected to be methodical rather than sudden. That sets up a demand tailwind over the next few weeks.

Mill City’s $450 million pivot into a dedicated SUI treasury is one of the most structurally bullish events the token has seen to date. This is not a short-term trade or VC allocation, it is a strategic shift by a publicly listed finance company, now aligning its entire treasury model with the long-term performance of SUI.

With 98 percent of net proceeds earmarked for acquiring SUI tokens through open market buys and direct deals with the Sui Foundation, this move introduces sustained institutional demand with daily liquidity.

The impact on price could be twofold. In the short term, this sets up a supply shock if purchases begin accumulating ahead of the July 31 closing. In the medium term, the endorsement by firms like Galaxy Digital, Pantera, and Electric Capital sends a strong market signal that SUI is becoming a preferred asset for institutional-grade treasury diversification.

Combined with Sui’s growing DeFi activity and AI-aligned infrastructure narrative, this treasury strategy places a floor under the token and raises the ceiling if broader market momentum returns. If these conditions align, SUI reclaiming $5 and testing new yearly highs looks increasingly plausible.

What’s Driving Long-Term Sentiment?

Beyond the SUI price chart and the treasury news, the onchain data is catching up. The Sui network hit a new DeFi TVL high of $2.22 billion, growing almost 400 percent in a year. That kind of ecosystem traction doesn’t go unnoticed, especially when the network is positioning itself as AI-ready infrastructure.

If institutions truly need scalable blockchains to support AI workloads, and if Sui price can deliver both speed and security, then Mill City’s move might be a signal of a broader narrative shift.

SUI Price Prediction: What Comes Next?

Keep an eye on the $4.35 resistance. A clean daily close above that level brings $5 into focus, with potential overshoot to $5.50 if market momentum aligns. On the downside, if $3.80 fails to hold, a retrace to $3.50 would not break the structure but would delay the breakout.

Right now, SUI price is trading inside a high-stakes zone where technicals, fundamentals, and institutional flows are all converging. If bulls hold their ground, the next leg up might not just be technical—it could be narrative-driven.

Buy SUI on OKX

Looking to buy SUI? OKX is one of the top exchanges with low fees, fast execution, and hundreds of listed assets.

👉 Join OKX here and claim your welcome bonus

$SUI, $SUIPrice

Global commerce has always been messy. Businesses lose billions just trying to send and receive money across borders. Traditional banking rails are clunky, slow, and expensive. Now, PayPal is stepping in to change that big time.

What Is Pay with Crypto?

PayPal just launched Pay with Crypto, a solution aimed at helping businesses accept payments in over 100 cryptocurrencies, including Bitcoin, Ethereum, Solana, XRP, and stablecoins like USDT and USDC. This isn’t just some token gesture toward digital assets—it's a full-blown infrastructure shift. The system plugs directly into wallets like Coinbase, MetaMask, Binance, Phantom, and Exodus, letting merchants tap into a global market of over 650 million crypto users.

Why It Matters?

Let’s break it down:

- Transaction fees? Slashed. Pay with Crypto charges just 0.99%—that’s a 90% reduction compared to traditional international credit card processing.

- Speed? Instant. Settlements are nearly real-time, meaning merchants get access to funds faster.

- Flexibility? Built-in. Merchants can accept crypto and get paid out in either fiat or stablecoins like PYUSD, PayPal’s own stablecoin.

This kind of setup levels the playing field for small businesses trying to operate globally. You could be a boutique in Oklahoma City and sell to a customer in Guatemala—no banks, no middlemen, no currency headaches. Just click, send, done.

Growing the PYUSD Ecosystem

PayPal’s stablecoin PYUSD is quietly becoming a powerful player. Beyond just enabling crypto payments, merchants can earn 4% APY by holding PYUSD on PayPal. It’s also the backbone for low-cost payouts to freelancers, suppliers, and partners.

And it’s not just PayPal alone—Fiserv is now on board to expand stablecoin usage globally. That partnership could bring PYUSD into more traditional payment workflows and enterprise systems.

Months ago, the SEC quietly closed its investigation into PayPal USD (PYUSD), effectively giving the stablecoin a green light. This wasn’t just a regulatory win for PayPal—it was a milestone moment for the entire stablecoin ecosystem. With no further action taken, PYUSD now stands as one of the few stablecoins backed by a major fintech player and aligned with U.S. regulatory expectations. It sets a precedent that could open the door for more banks and payment platforms to explore compliant digital dollar offerings.

A Bigger Vision: PayPal World

The launch of PayPal World is another piece of this strategy. It brings together five of the world’s largest digital wallets on a single platform. Combined with crypto payment capabilities, PayPal is building what CEO Alex Chriss calls “inclusive, borderless commerce.”

He’s not exaggerating. With coverage of 90% of the $3 trillion crypto market cap, and integrations across major wallet providers, this isn’t some beta experiment—it’s the infrastructure for a new kind of global economy.

So What Comes Next?

For now, Pay with Crypto rolls out to U.S. merchants in the coming weeks, but the writing’s on the wall. This isn’t just about PayPal jumping on the crypto bandwagon—it’s about rewriting how digital money moves across borders, how businesses grow, and how people get paid. In short, PayPal is not just supporting crypto. It’s putting it to work.

$PYUSD, $PayPal, $PayWithCrypto

Decrypt

Strategy has raised capital through newly listed preferred shares to purchase another 21,021 BTC, lifting its total stash to nearly 629,000.

Here’s our review of ‘Copilot Mode,’ an experimental revamp to Microsoft’s Edge browser that makes it even more AI centric.

The Nym token has jumped considerably in the past day as UK VPN demand spikes 6,000% amid a new age verification law.

The firm expects to hold about 43,500 Bitcoin after stablecoin giant said it would provide more digital coins.

Steam dumped adult games following pressure on payment providers. Now, Collective Shout says crypto payment firms could be targeted next.

U.Today - IT, AI and Fintech Daily News for You Today

Market will take another swing at local resistance levels in attempt to return to bull mode

Crypto market today: key points

Coinbase has continued to expand its crypto offerings

RLUSD is turning into an increasingly important player within the decentralized finance ecosystem

The SEC has finally approved in-kind redemptions for Bitcoin and Ethereum ETFs, boosting efficiency and lowering costs

Blockonomi

TLDR:

- PayPal Venmo payment volume rose 45%, fueling its fastest revenue growth since 2023.

- PayPal branded payment volume grew 8%, fueled by better checkout and higher engagement.

- Buy Now, Pay Later usage increased 20%, strengthening PayPal’s digital payments dominance.

- Braintree rebounded as PayPal shifted focus from cost-cutting to scaling transaction volume.

PayPal’s quarter 2 looked more like a strong market breakout than a routine earnings update. The company is growing across payments, checkout, and even Venmo, where activity has hit a new pace.

More users are paying, spending, and sticking around. This is not just numbers on a report. It signals how fast digital payments are shifting and why PayPal is pushing forward.

PayPal Branded Payments See Heavy Demand

PayPal CEO Alex Chriss reported an 8% rise in branded payment volume. Active accounts grew 2%, showing more people are not only signing up but using the platform regularly. He linked this to upgrades in PayPal’s checkout system, which improved merchant conversions and sped up transactions.

1/ PayPal released strong second quarter results this morning, driven by continued strength across many of our strategic initiatives, ranging from @PayPal and @Venmo branded experiences to processing and value-added services. Based on our momentum, we are raising our full-year…

— Alex Chriss (@acce) July 29, 2025

Buy Now, Pay Later volume rose 20%, adding another layer of growth. Venmo, in particular, stood out with over 45% more payments made using its branded option. Venmo debit cards also saw monthly active users jump 40%.

Venmo’s revenue climbed over 20%, its fastest increase since 2023. Total payment volume rose 12%, marking its highest growth rate in three years. Chriss tied this momentum to new campaigns and partnerships, including collaborations with major sports conferences.

This mix of marketing and product expansion is pulling more users into Venmo’s ecosystem. More importantly, it is translating directly into transaction growth. That steady climb shows Venmo is no longer just a peer-to-peer app. It is becoming a key driver in PayPal’s overall growth.

Braintree and Core Services Bounce Back

Chriss confirmed Braintree’s payment volume returned to growth after several quarters of cuts to focus on profitability. This marks a shift from trimming down to scaling up again. For merchants, it signals a broader push to bring more payment processing volume back into PayPal’s network.

Additionally, debit card engagement jumped 60%. This reinforces how PayPal is layering services, keeping users tied to its ecosystem while increasing overall transaction flow.

Chriss said PayPal is now leaning into new areas like AI, stablecoins, and its PayPal World platform. The company aims to build a connected ecosystem where payments, commerce, and digital tools work seamlessly together. For investors and crypto watchers, this focus is worth tracking.

PayPal is not just refining payments. It is positioning itself at the intersection of finance and technology. And based on this quarter, it’s moving with momentum.

The post PayPal Q2 Results Show Crypto-Like Growth as Venmo and Checkout Surge appeared first on Blockonomi.

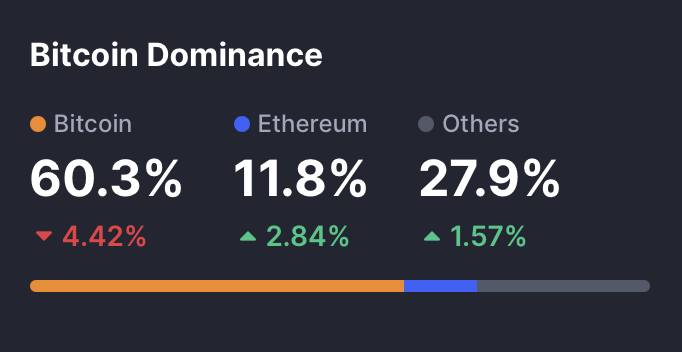

Despite a flurry of altcoin rallies and renewed buzz around Ethereum ETFs, the crypto market continues to lean heavily into Bitcoin. According to CoinMarketCap’s Altcoin Season Index, the current reading of 39 out of 100 confirms that we’re in Bitcoin Season, with capital consistently flowing back to the market’s most established asset. Even as altcoins like SUI and BNB post impressive weekly gains, broader investor confidence appears concentrated in BTC.

In this context, early-stage presales like MAGACOIN FINANCE are emerging quietly as top altcoin contenders, offering a strategic play for those seeking upside outside institutional pipelines.

Bitcoin holds firm as institutions favor stability

Bitcoin’s dominance rate sits at 60.32%, reflecting an 18.5% increase over the past 30 days. The growth has persisted even as spot Ethereum ETF assets under management surpassed $9.33 billion. Traders, however, appear reluctant to shift capital into altcoins, citing macro volatility and Ethereum’s lagging derivatives performance. Bitcoin, with its deep liquidity and regulatory clarity, remains the smart money’s preferred risk-adjusted play—especially as ETF-driven inflows provide ongoing structural support.

While large-cap altcoins stumble, retail focus is shifting toward early-stage tokens with high multiple potential. MAGACOIN FINANCE is leading that wave. Its explosive presale growth and rapidly expanding Telegram base are turning heads across crypto Twitter. With batch sales closing in record time and community participation metrics hitting new highs, analysts now project that $1,300 invested early could return up to $75,400—representing a potential 58x rally if current demand accelerates through Q3.

This mirrors the rotation we’ve seen in past cycles, where retail front-runs institutions by identifying viral opportunities before mainstream listings. MAGACOIN FINANCE’s model of political engagement, deflationary supply, and grassroots expansion is winning favor from crypto veterans and newcomers alike.

Derivatives and liquidations show risk-off for alts

Even with attention spikes around assets like VINE – sparked by Elon Musk teasing Vine’s comeback—altcoin positions remain fragile. Binance Futures data shows that 87% of derivatives volume is concentrated in Bitcoin, while Ethereum funding rates have turned negative (−0.0094%). Meanwhile, $9.4 million in VINE long positions were liquidated, reflecting a persistent lack of confidence in altcoin breakouts.

Compared to Bitcoin’s short liquidation of just $16.17 million, the message from futures markets is clear: traders remain defensive and selective—favoring BTC’s structural stability over altcoin hype.

Conclusion: Capital follows conviction—and conviction follows Bitcoin

The momentum may shift quickly in crypto, but for now, Bitcoin remains the asset of choice for institutions and cautious traders. Until altcoins offer clearer catalysts backed by ETF flows or major adoption headlines, sector-wide rotation seems unlikely. However, the appetite for high-upside exposure remains—especially through fast-moving altcoin presales like MAGACOIN FINANCE, where research updates now project a 58x rally for proactive holders. As Bitcoin anchors the top, nimble investors are turning to presales for growth.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

The post Altcoins vs. Bitcoin: Smart Money Picks a Side appeared first on Blockonomi.

The recent filings for a XRP ETF ignited fervor in the crypto world, drawing comparisons to Bitcoin and Ethereum ETF cycles. Traders flooded in, pushing XRP past key resistance levels as open interest and derivatives trading climbed. Social platforms buzzed with excitement, even as regulatory hurdles linger. While the prospect of a XRP ETF remains uncertain, the filing itself elevated XRP’s profile—even without official approval.

This phase of speculation has triggered broader altcoin attention. Capital rotation is now moving toward PEPE, TRON, and Ethereum—each attracting renewed speculative interest. As the XRP ETF hype transitions into longer-term positioning, traders are preparing for what could be the next wave of breakout assets. That includes MAGACOIN FINANCE, quietly building traction in presale circles.

Speculative interest spreads beyond Ethereum

As talk of a potential XRP spot ETF gains traction, speculative energy is quickly shifting toward assets tied to real utility and legal clarity. XRP’s recent legal victories and growing integration into institutional frameworks have made it a frontrunner in the next ETF wave. Traders are watching closely as rumors of issuer filings and exchange interest fuel broader momentum.

Alongside this, meme assets like PEPE are also riding a new wave of speculative demand, driven by retail narratives and viral traction. In parallel, Ethereum continues to benefit from staking momentum and ETF inflows, but capital is clearly rotating into fresh, higher-beta stories like XRP.

Momentum builds in high-velocity presales

Against this backdrop, MAGACOIN FINANCE is drawing increasing attention. Its presale is advancing rapidly, reflecting a fast-growing user base and referral-driven mechanics. According to market models, a $1,500 entry today could potentially grow to $27,000, positioning the token as one of the fastest-moving coins in 2025.

Its branding strategy combines political satire with crypto native mechanics—creating a high-angle narrative that seamlessly attracts trader curiosity. While it lacks institutional backing or difficult infrastructure, it does mirror the energy of early-stage breakouts that helped define prior cycles. For many investors rotating out of XRP into smaller, cultural tokens, this presale represents a potential winner at the right moment.

Continued rotation signals altcoin season setup

XRP’s ETF filing may be the spark, but broader market behavior is telling a longer story. Ethereum staking funds, regulatory clarity, and on-chain activity are all catalyzing capital flow within the ecosystem. TRON is also seeing renewed developer interest and possible ETF speculation, while community tokens like PEPE benefit from stylistic resurgence.

In this environment, narrative-driven tokens with social velocity—such as the ones we mentioned earlier in the article—can capture outsized attention early. As traders rotate from XRP’s into smaller plays, coins with built-in referral and community models may outperform slowly evolving protocols.

Conclusion

The XRP’s ETF filing has shifted altcoin dynamics—elevating PEPE, TRON, Ethereum, and high-velocity presale tokens as the next frontier. MAGACOIN FINANCE is riding that wave, with a narrowing entry window and forecasts showing $1,500 presale today may become $27,000 for early participants. If the capital flow continues, speculative narratives like these could define the next phase of meme coin momentum in 2025.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

The post After XRP ETF Mania—PEPE, TRON, Ethereum, and MAGACOIN FINANCE Poised for Major Breakouts appeared first on Blockonomi.

PEPE, PEPETO, Little Pepe: the frog battle

The hottest meme coin of 2025 has just taken the lead. Pepe had its moment, Little Pepe is chasing trends, but Pepeto is built to win. Pepe exploded in 2023 on pure meme hype, but with a massive market cap, its growth is now limited. Little Pepe brings a Layer 2 chain narrative, yet at $0.0017, its price leaves little room for big gains , realistically capping its upside at around x3. Pepeto, however, is still at a ground‑floor presale price of $0.000000143, giving early buyers a rare chance at a potential x100 breakout.

More than just hype, Pepeto delivers real value through its zero‑fee exchange, PepetoSwap, and cross‑chain bridge, making it the meme coin with both utility and explosive upside. Which give much more potential to Pepeto and Little Pepe since they are still on presale phase, with attractive low prices, that is why Pepe won’t be a smart investment to make as the call was succesfully taken when PEPE was in presale prices.

Ethereum Hype Drives Pepeto Toward the Next x100 Opportunity

Pepeto’s presale is on fire, and it’s listing is near. Surging past $5.6 million, it has quickly become one of the strongest meme‑driven Ethereum projects of the year. But Pepeto isn’t just leaning on flashy branding or meme humor , it’s following the same winning playbook that made Shiba Inu and Pepe legendary, turning small bets into life‑changing gains. Investors who watched Shiba turn a few hundred dollars into millions or saw Dogecoin hit all‑time highs understand why Pepeto is being called the next x100 contender.

Its supporters aren’t just buying into hype. They’re backing a project that delivers real value with a zero‑fee centralized exchange, PepetoSwap, and a cross‑chain bridge built to revolutionize meme coin trading. With over 100,000 active community members, Pepeto has become one of the most talked‑about presales of 2025, fueled by viral campaigns and relentless social media buzz as well as rumours (Ex founder of PEPE being behind the PEPETO project after being betrayed) related to PEPE that keep the momentum climbing, especially with the story of PEPETO and the same max supply of both tokens : 420T.

Little Pepe’s Layer 2 Push Sparks Interest, But Is It Enough?

While Pepeto builds utility‑backed momentum with its zero‑fee exchange, PepetoSwap, and cross‑chain bridge, Little Pepe brands itself as “The Newborn EVM Layer 2 Machine,” promising a low‑cost, lightning‑fast chain powered by the Little Pepe protocol. This positioning has fueled engagement and created loyalty among presale participants.

Little Pepe may bring fresh tech to the table, but Pepeto combines community, story, and working infrastructure to dominate the next meme wave. With a presale still at entry‑level pricing and the potential for x100 growth, Pepeto is shaping up to be the breakout meme coin of this cycle.

Speculation vs Strategy: Pepeto Coin or Little Pepe?

Little Pepe has gained attention as a Layer 2 EVM-powered meme ecosystem, but much of its traction comes from its branding and early‑stage hype. Pepeto’s presale, by contrast, is structured for long‑term growth, combining meme culture’s viral appeal with tangible infrastructure like its zero‑fee exchange, PepetoSwap, and cross‑chain bridge that drive real adoption. With 420 trillion tokens (matching PEPE’s supply) priced at just $0.000000143, Pepeto offers one of the highest upside entry points in the market, giving early buyers a rare ground‑floor opportunity.

Two Big Presales, One Clear Winner

Little Pepe may be making noise with its Layer 2 story, but Pepeto is stealing the spotlight. Its presale has soared past $5.6 million and continues to accelerate as it captures mainstream meme coin attention. Backed by a community of over 100,000 members and echoing the historic success of tokens like Pepe and Shiba, early buyers are locking in positions for what could be exponential growth as Pepeto’s listing draws near.

Layer 2 technology is no longer rare , it’s everywhere. Dozens of projects are pitching “fast and cheap” Layer 2 chains, making it more of a repeatable trend than a breakthrough. Pepeto, on the other hand, is bringing something truly different: a zero‑fee exchange, PepetoSwap, and a cross‑chain bridge that solves real trading problems in the meme coin space.

And when it comes to potential gains, the difference is massive. Little Pepe’s presale price near $0.0017 leaves limited room for growth, realistically capping its upside at around x3, while Pepeto’s ground‑floor entry at just $0.000000143 opens the door for truly exponential returns. This is why investors are flocking to Pepeto , it’s not just another chain, it’s a project with real tools and life‑changing upside.

What $10,000 in Pepeto Could Become

At the current presale price of $0.000000143, a $10,000 investment in Pepeto, and if it only reaches PEPE’s current price of $0.00001253, that same $10,000 would be worth nearly $870,000 : a staggering 87x return, let alone when it exceeds Pepe price thanks to its exchange use, showing the massive upside potential for early investors entering now.

Time to Act, Not Watch

Short term crypto investing isn’t about luck, it’s about timing, momentum, and grabbing the right coin before it takes off. Pepeto (PEPETO) : To buy visit : https://pepeto.io , with its zero fee exchange, PepetoSwap platform, and viral traction, leads the charge with serious 100x potential.

Start by securing your Pepeto presale allocation now, before prices rise again. Then, stay active in the community as the project continues to expand. The next meme wave is forming, and this time, it has real utility driving it. Supported payment options include USDT, ETH, BNB, and CARD PAYMENT and via MetaMask or Trust Wallet.

For more information about PEPETO visit the links below :

Website : https://pepeto.io

Whitepaper : https://pepeto.io/assets/documents/whitepaper.pdf?v2=true

Telegram : https://t.me/pepeto_channel

Instagram : https://www.instagram.com/pepetocoin/

Twitter/X : https://x.com/Pepetocoin

The post Pepeto vs Pepe vs Little PEPE as Presale Pushes Pepeto Toward The Next x100 Meme Coin In This Bull Run appeared first on Blockonomi.

TLDR:

- RAKBANK becomes the first UAE bank to enable direct crypto trading in dirhams.

- Partnership with Bitpanda integrates secure crypto access into RAKBANK’s mobile app.

- No foreign currency fees or external transfers required for crypto transactions.

- Early invitation-only rollout set to expand across UAE retail banking customers.

RAKBANK has taken a step no other UAE bank has. The bank now allows its customers to trade crypto straight from its mobile app. No transfers to external exchanges. No foreign currency charges. Everything happens in dirhams, within a regulated environment.

This move signals a major shift in how crypto meets traditional banking in the UAE.

RAKBANK to Offer Crypto Access Without the Extra Steps

With this launch, RAKBANK customers can buy, sell, and swap crypto directly from their accounts.

Access comes through Bitpanda’s platform, integrated into the bank’s app. All transactions settle in AED, removing the usual costs tied to foreign transfers and conversions.

The setup avoids the back-and-forth most traders face when moving funds between banks and crypto exchanges. It keeps the process simple while staying within UAE regulations.

This offering is built on RAKBANK’s partnership with Bitpanda. The company runs its regional entity under Dubai’s Virtual Assets Regulatory Authority. It also operates under several European regulators, giving the service a global compliance backbone.

Bitpanda already works with major financial institutions like Deutsche Bank and N26. By teaming with RAKBANK, it brings the same infrastructure to the UAE’s retail banking market.

Early Rollout and Future Expansion

Right now, the crypto service is invitation-only. RAKBANK plans to roll it out to more customers over the coming months. The bank sees it as a way to merge regulated finance with digital assets in a straightforward way.

The bank’s leadership described it as a direct response to customer demand for safer and easier crypto access. The goal is to provide a simple path into the market, without the barriers or risks that come with unregulated platforms.

This move could reshape how crypto fits into UAE banking. It removes unnecessary steps while keeping everything compliant. For customers, it means crypto trading in dirhams, no hidden conversion costs, and no leaving the security of their bank.

If the early rollout succeeds, this could set a model for other banks in the region.

The post RAKBANK Launches First UAE Bank-Backed Crypto Trading in Dirhams via Bitpanda appeared first on Blockonomi.

CryptoPotato

TL;DR

- Whales have purchased nearly $850 million worth of ETH in just two days.

- Other bullish signals for the cryptocurrency include the declining supply of tokens on exchanges and the solid interest in spot Ethereum ETFs.

The Largest Whales on the Move

Despite not posting any major gains in the past 24 hours, Ethereum (ETH) remains among the top-performing cryptocurrencies over the last month, with its price soaring by 54% to the current $3,800 (according to CoinGecko’s data).

Moreover, the recent whale activity suggests that the valuation may pump even more in the short term. The popular X user Ali Martinez revealed that big investors (those holding between 10,000 and 100,000 coins) have scooped up more than 220,000 ETH in the past 48 hours.

The USD equivalent of the stash is just under $850 million (calculated at current rates), with this cohort of market participants now controlling almost 28.4 million tokens. This represents 23.5% of ETH’s circulating supply.

Such accumulation leaves fewer assets available on the open market, which, combined with non-declining demand, is supposed to result in a surging price. Additionally, the move may incentivize smaller investors to enter the ecosystem with fresh capital.

Martinez has been quite vocal on ETH recently. Earlier today (July 29), he noted that there has been plenty of hype surrounding the second-largest cryptocurrency, but predicted that “the real breakout” will begin once the price soars above $4,100.

The X user Michael van de Poppe said ETH didn’t witness the previously expected correction. “In that case, I think we’ll be seeing another run upwards, the target is quite clear: the high at $4,100. I think we’ll sweep that level and consolidate for a little. Up we go,” he added.

More Bullish Factors

The outflow from exchanges has been more than evident in the past several months. Over one million ETH has been withdrawn from centralized platforms in the last 30 days alone, which typically results in reduced immediate selling pressure.

As CryptoPotato reported, the total number of Ethereum tokens stored on exchanges has plunged to approximately 19 million, representing the lowest point seen in nearly a decade.

The massive capital that continues to flow into spot ETH ETFs should also be considered a bullish element. Those products have collectively attracted roughly $5 billion in 17 days, signaling solid interest from investors. In fact, the last outflow day was on July 2.

The post 220,000 ETH in 48 Hours: Ethereum Price Rally on the Way? appeared first on CryptoPotato.

CEA Industries Inc., a Canadian vape company, saw its stock surge by 550% following its pivot into digital assets.

The entity announced it had priced an oversubscribed and upsized PIPE financing round, backed by 10X Capital and YZi Labs, in a bid to transform into a BNB-focused treasury vehicle.

BNB Treasury Move

In an official press release, CEA said that it aims to become the largest publicly traded BNB treasury company in the United States and bring institutional exposure to Binance’s native Layer 1 blockchain asset. The PIPE, priced above market, attracted over 140 subscribers from across the globe, including leading crypto investment firms like Pantera Capital, GSR, and Blockchain.com.

Post-closing, CEA said that it plans to begin deploying capital into BNB. The company’s new leadership includes crypto veterans David Namdar (Galaxy Digital co-founder), Russell Read (former CIO of CalPERS and Deutsche Bank Asset Management), and Saad Naja (formerly of Kraken and Exinity).

This pivot represents one of the first institutional-scale vehicles providing BNB exposure through public markets.

Talking about the development, Namdar said,

“BNB Chain is one of the most widely used blockchain ecosystems globally, yet institutional access has been limited until now. By creating a US-listed treasury vehicle, we are opening the door for traditional investors to participate in a transparent way. This is a significant step in bridging digital assets and mainstream capital markets.”

Treasury Diversification Ramps Up

The latest development comes just days after Nasdaq-listed Windtree Therapeutics announced plans to raise $520 million to expand its BNB crypto reserves. The raise includes a $500 million equity line of credit (pending shareholder approval) and a $20 million stock purchase agreement with Build and Build Corp.

It said 99% of proceeds will go toward acquiring BNB. The company has partnered with Kraken for custody and trading support.

Windtree joins a growing list of firms, including Nano Labs, turning to BNB over Bitcoin or Ethereum as institutional altcoin adoption gains momentum.

The post This Vape Company Aims to Establish the Largest Publicly-Traded BNB Treasury Firm in the US appeared first on CryptoPotato.

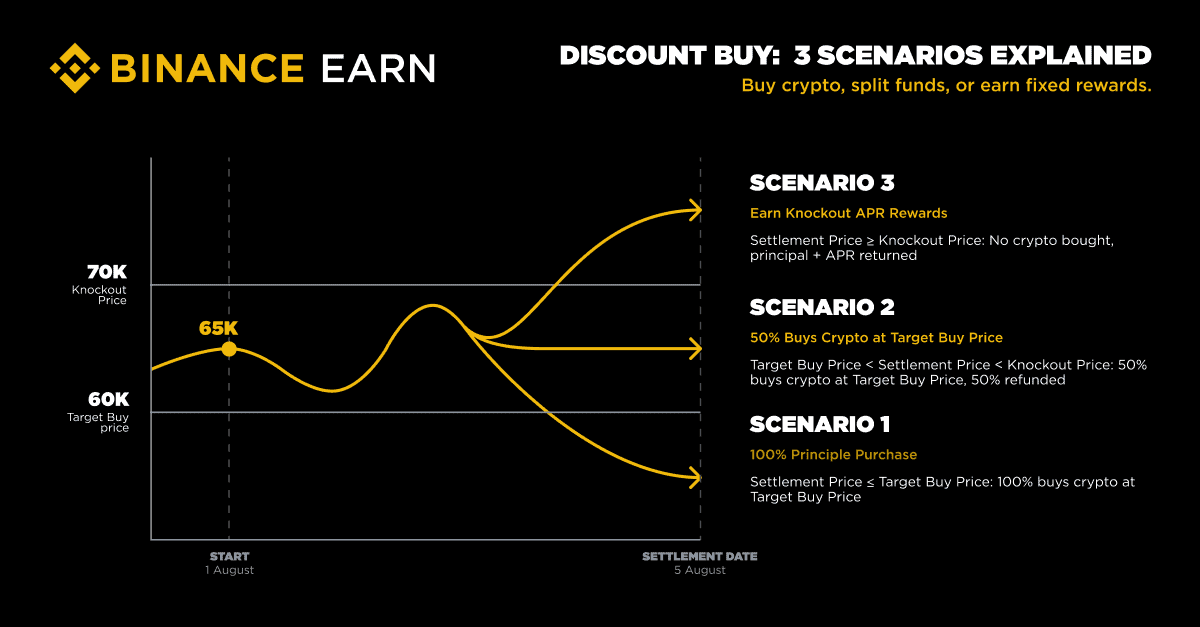

The flagship product will enable customers to make advanced purchases of cryptocurrency in markets with lower volatility.

There will be several possible scenarios for placing orders, all of which are supposed to work in the user’s favor.

Pre-Order Your Crypto

In a press release shared with CryptoPotato, Binance, the company behind one of the largest blockchain ecosystems and exchanges, announced the launch of Discount Buy today.

This is a new product from Binance’s Earn portfolio, enabling patrons to lock in future cryptocurrency purchases at pre-defined prices below the current market rate, or earn a fixed Annual Percentage Rate (APR) if the purchase does not execute.

Discount Buy offers a flexible way to accumulate assets like Bitcoin, Ethereum, BNB, or Solana in low-volatility markets, eliminating the need to monitor prices or time your orders.

“Discount Buy is well-suited for users who anticipate limited price fluctuations and want to accumulate crypto at a discount without needing to time the market or monitor prices closely,” said Jeff Li, VP of Product at Binance.

“It offers flexibility across investment scenarios, giving users more choices and opportunities in how they want to participate in the crypto market.”

How It Will Work

Clients can subscribe to the feature by using stablecoins (like USDC or USDT) and selecting a fixed-term product with preset conditions.

The stated conditions include the Target Buy Price (the price at which you want to buy crypto), a Knockout Price (a price ceiling that determines reward eligibility), a fixed APR, and a Settlement Date.

The Settlement Price is defined as the average market price over a 30-minute window on the Settlement Date (07:30–08:00 UTC), and is used to determine which outcome applies. The result depends on how the market price compares to these levels:

- Scenario 1: 100% Principal Purchases — If the Settlement Price is less than or equal to the Target Buy Price, 100% of the user’s investment is used to buy crypto at the Target Buy Price.

- Scenario 2: 50% Principal Purchases — If the Settlement Price is greater than the Target Buy Price but less than the Knockout Price, 50% of the user’s funds are used to buy assets at the Target Buy Price, and the remaining 50% is returned in stablecoins.

- Scenario 3: Receive Principal and APR — If the Settlement Price is greater than or equal to the Knockout Price, the user receives their full investment back, along with APR rewards.

There are no trading fees for purchases, and the currently supported currencies are BTC, ETH, BNB, and SOL. Once the subscription has been set, the Purchase Price, Knockout Price, duration, and APR are fixed and cannot be modified.

The post Binance Earn Unveils Feature Letting Users Buy Crypto at a Discount appeared first on CryptoPotato.

CoinDCX CEO Sumit Gupta has refuted rumors of a potential $900 million purchase of the platform by Coinbase.

The development follows a $44 million crypto hack that affected the Indian exchange two weeks ago.

$900M Coinbase Deal

On Monday, an Indian news outlet reported that Coinbase was in “advanced discussions” to acquire CoinDCX. Citing two anonymous sources familiar with the matter, the article had alleged that the deal would be worth just under $900 million, a 60% discount from its $2.2 billion valuation from three years ago.

However, CEO Gupta has since disproved the news via a July 29 X post: “Ignore the rumours! CoinDCX is ‘super focused’ on building for India’s crypto story and not up for sale!” He added that he will share more details on the exchange’s plans very soon.

Founded in 2018 by Gupta and Neeraj Khandelwal, CoinDCX became India’s first crypto unicorn after being valued at $2.2 billion in 2022. The platform is backed by global heavyweights including Coinbase Ventures, Polychain Capital, and B Capital Group.

The now-debunked reports had claimed that Coinbase views the acquisition as a strategic investment to re-enter and expand in the Indian crypto market following its exit in 2023 due to regulatory challenges.

The exchange paused UPI payments and trading services shortly after launching in India, due to pressure from the Reserve Bank of India (RBI). The company later stopped services for the region’s users in 2023, but did not officially say it was leaving the country. Following its registration with the Financial Intelligence Unit (FIU) in March, Coinbase now has permission to offer crypto services in India under local rules.

CoinDCX $44M Breach

On July 19, CoinCDX fell victim to a $44.2 million security breach that targeted one of its internal operational wallets used for liquidity management.

Blockchain investigator ZachXBT was the first to raise an alarm about suspicious outflows nearly 17 hours before the firm issued a public statement. According to the on-chain sleuth, the attackers drained the wallet’s USDC and USDT tokens, then laundered the funds using Solana-Ethereum bridges and Tornado Cash.

Gupta later assured users that the platform’s security systems ensured all customer funds remained unaffected and secure in offline cold storage. He explained that the incident was caused by a sophisticated server breach. Last week, CoinDCX also launched a recovery bounty program, offering white hat hackers up to 25% of any funds they successfully help trace and recover.

The post CoinDCX CEO Denies Reports of a $900M Acquisition by Coinbase appeared first on CryptoPotato.

TL;DR

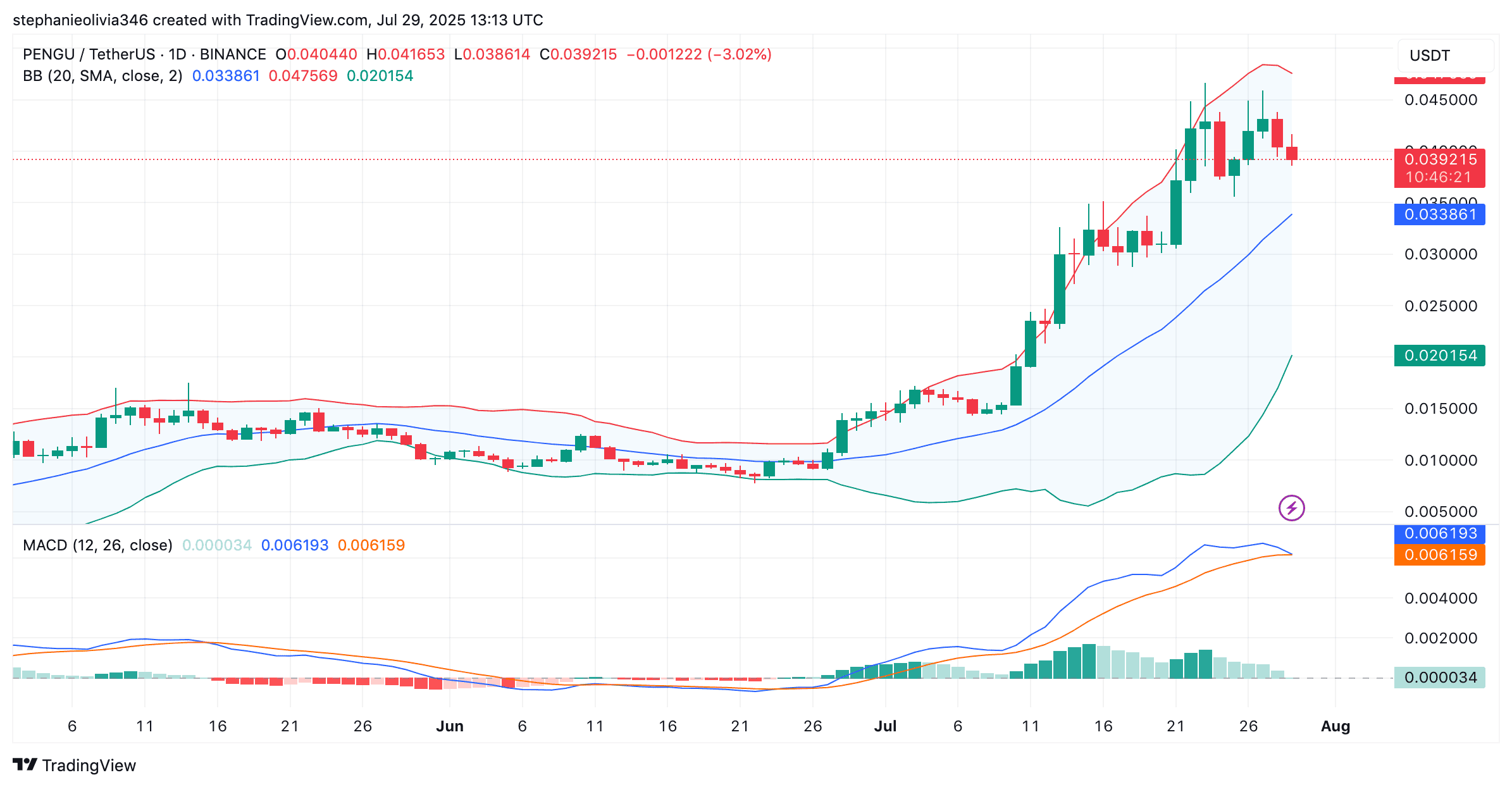

- PENGU rejected at $0.043, but the daily chart structure remains bullish above short-term support.

- Whale activity increases on Upbit as traders shift from Dogecoin to Pudgy Penguins positions.

- Momentum shows early signs of fading as MACD flattens, with $0.038 key for trend support.

Price Pulls Back From Resistance

Pudgy Penguins (PENGU) was trading at $0.038, marking a 9% drop in the last 24 hours. Over the past week, it has remained up by about 5%. On the daily chart, the price rejected the $0.043 mark, which now acts as resistance. This level has been tested several times, showing increased sales in that area.

According to market watcher Lennaert Snyder, this kind of pullback is expected under current market conditions. The overall move since July looks bullish with the price making new higher lows and breaking higher. A further push beyond to $0.043 will validate the strength and a new high.

$PENGU is one push away from printing a new ATH.

It rejected $0,43 resistance which is normal looking at market conditions.

Daily support is laying around $0.376, a retest there is a dream for longs.

Reclaiming $0,43 = fresh ATH.@pudgypenguins are ready to fly high. pic.twitter.com/kKMt4OUtTQ

— Lennaert Snyder (@LennaertSnyder) July 29, 2025

If PENGU clears the $0.043 level with volume support, chart tools suggest $0.073 as the next possible stop. This area lines up with a Fibonacci extension from a recent impulse wave. For now, the token needs to hold above short-term support and keep pressing against resistance.

Snyder’s chart layout shows the path to $0.073 depends on follow-through. Without that, the market could remain in a range. A clean break and retest would be key to maintaining bullish momentum.

Large Traders Rotate Into PENGU

Trading activity on Upbit has shown strong interest from larger accounts, according to analyst Cas Abbé. They noted that PENGU’s volume has surpassed Dogecoin, pointing to a possible shift in focus. Abbé added that some traders are adjusting their positions in favor of Pudgy Penguins.

After falling off after its $1.5 billion airdrop, the asset bounced back and started to climb again. Current trading patterns imply that some traders are looking for a bigger move over the next few weeks.